“Central banks are losing control and they don’t know what to do … just like the Republican establishment and Donald Trump.” ~ Jeffrey Gundlach

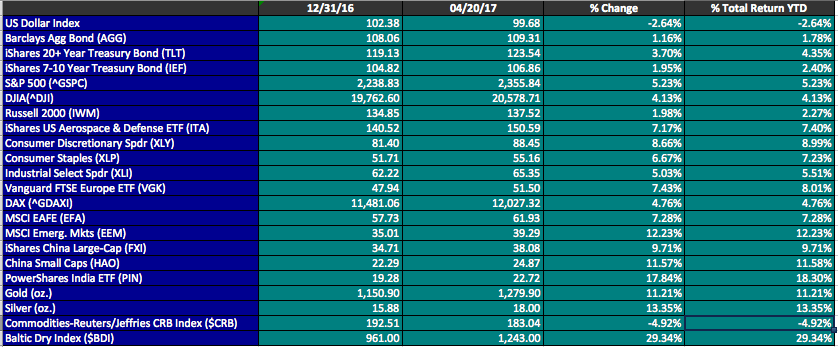

During the 1st Quarter, the fixed income markets adjusted to the Fed’s next interest rate increase while the post-election surge in equities appeared to run its course. European equity markets outperformed the US markets and emerging market equities did best of all.

US Dollar Index

Fixed Income

AGG (US Bond Aggregate), JNK (High Yield Bond ETF)

IEF (5-7yr Treasury ETF), TLT (20 yr. + Treasury ETF)

Equities

SPX (S&P Large Cap), PKW (Buybacks)

SCHA (U.S. Small Caps), SCHM (U.S. Mid Caps), SCHX (U.S. Large Caps)

US Aerospace & Defense (ITA)

Consumer Discretionary (XLY)

Consumer Staples (XLP)

Industrial Select (XLI)

U.S. Financials ETF (IYF)

S&P Regional Banking (KRE)

Health Care (XLV)

IBB (Biotech)

ITB (U.S. Home Construction)

IYR (U.S. Real Estate)

Motif Investing Highest Earners

Motif Investing Lowest Earners

EFA (International Developed)

EUROPE

DAX (Germany)

VGK (FTSE)

VGK (FTSE), EWU (UK), SPY (S&P)

EUFN (European Financials), KBE (US Financials)

European Financials: DB (Deutsche Bank), RBS (Royal Bank of Scotland), BCS (Barclays), BNPQY (Paribas)

Asia

EEM (Emerging Markets)

FXI (China Large Caps)

China Small Cap (HAO)

PIN (India)

WAFMX (Frontier Markets)

Commodities

OIL (Crude Oil)

RSX (Russia), OIL (Crude Oil)

GLD (Gold), SLV (Silver)

GDX, GDXJ (Mining, Junior Mining)

CRB (Commodities Index)

Baltic Dry Index